Rising healthcare costs are becoming one of the most persistent financial pressures facing Indian households, cutting across income levels and regions. While healthcare access has expanded over the years, the price of treatment, diagnostics, and medicines has climbed steadily, forcing families to reassess savings priorities and long-term financial planning.

For many, a single hospitalisation is enough to disrupt household budgets, exposing gaps in health insurance coverage and highlighting the growing burden of medical expenses in India.

Why Healthcare Is Becoming More Expensive

Experts attribute healthcare inflation to multiple factors. Advances in medical technology, while improving outcomes, have also increased treatment costs. Hospitals face higher operational expenses, including skilled staffing, imported equipment, and compliance requirements.

Additionally, lifestyle-related illnesses such as diabetes, heart disease, and respiratory conditions have increased demand for long-term care. This shift has significantly raised hospital treatment costs, particularly in urban centres.

Out-of-Pocket Spending Remains High

Despite wider insurance awareness, India continues to see high out-of-pocket expenditure on healthcare. Many policies do not fully cover diagnostics, consumables, or post-hospitalisation care, leaving families to absorb unexpected expenses.

According to health economists, rising healthcare costs disproportionately affect middle-income families who may not qualify for public schemes yet struggle to afford comprehensive private coverage.

This financial vulnerability often leads households to dip into savings or take short-term loans to manage urgent medical needs.

Insurance Coverage Gaps Add to the Pressure

While health insurance penetration has improved, coverage limits often lag behind actual hospital treatment costs. Policy exclusions, waiting periods, and co-payment clauses can significantly reduce claim payouts.

Insurance advisors recommend periodic policy reviews to ensure coverage keeps pace with medical expenses in India, particularly as healthcare inflation outstrips general inflation in many regions.

Impact on Household Financial Planning

The uncertainty around medical emergencies has changed how families plan finances. Emergency funds are increasingly prioritised, while discretionary spending and long-term investments may take a back seat.

Financial planners say rising healthcare costs are now a key consideration in retirement planning, especially for senior citizens who face higher treatment frequency and limited income sources.

Government and Regulatory Oversight

Public health authorities have acknowledged the need to control costs while expanding access. According to guidance and reports issued by the Ministry of Health and Family Welfare, efforts are ongoing to strengthen public healthcare infrastructure and regulate pricing of essential medicines.

“As per the Ministry of Health and Family Welfare, initiatives to improve affordability and access remain central to reducing the long-term impact of rising healthcare costs.”

Urban–Rural Divide in Medical Costs

Healthcare affordability also varies sharply between urban and rural areas. While rural regions may have lower treatment costs, access to advanced facilities is limited, often forcing patients to travel to cities where hospital treatment costs are significantly higher.

Urban hospitals, meanwhile, face capacity pressures that further drive up prices, particularly during health emergencies or seasonal disease outbreaks.

How Families Can Reduce the Financial Burden

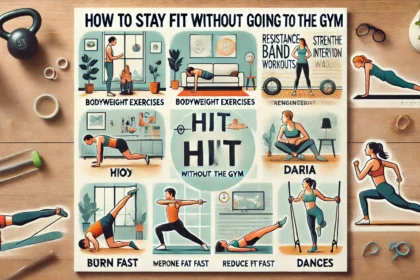

Experts suggest practical steps to manage healthcare inflation:

- Maintain adequate emergency health funds

- Review insurance coverage annually

- Opt for preventive health check-ups

- Compare hospital costs where possible

- Use government-supported schemes when eligible

Preventive care, in particular, can help reduce long-term medical expenses India by identifying health issues early.

A Growing Household Concern

As healthcare becomes more complex and technology-driven, costs are unlikely to stabilise quickly. Analysts warn that without careful planning, rising healthcare costs could continue to erode household financial security.

For families, awareness and preparation remain the most effective tools to navigate an increasingly expensive healthcare landscape.

Looking Ahead

Balancing quality healthcare with affordability remains one of India’s biggest policy challenges. As reforms evolve, households must stay informed, proactive, and financially prepared to manage the realities of modern medical care.

For now, rising healthcare costs are no longer a distant concern — they are a central part of everyday financial decision-making for millions of Indian families.

Related: Corona Remedies Share Price Live: Pharma Stock Gains Momentum

Related: EPF UPI Withdrawal Rules: Employees Can Withdraw 75% of PF via UPI