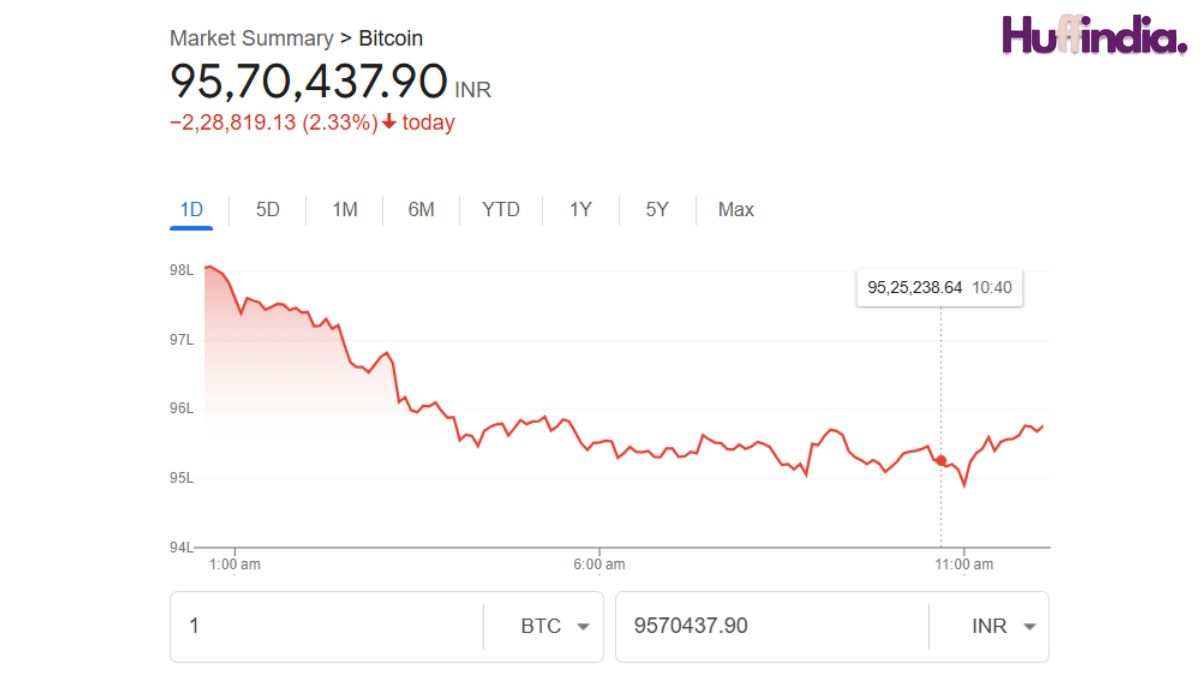

Bitcoin price today has deteriorated significantly, falling below the $108,000 threshold with a sharp 2.48% decline recorded over the preceding 24-hour trading period. The leading digital asset is presently trading at $107,968.75, representing a concerning correction from the $111,000+ levels witnessed at November’s inception merely three trading sessions ago. This $3,000+ decline underscores mounting selling pressure and deepening investor caution amid uncertain macroeconomic conditions that have collectively shifted sentiment from optimism to defensive positioning across the cryptocurrency market.

The ongoing crypto weakness challenges widely held assumptions about November’s traditional bullish seasonality within digital asset trading communities. Historically, November has supported cryptocurrency market recovery following September-October weakness, with traders citing an average 42% historical gain since records began. However, 2025’s current downturn suggests macroeconomic headwinds may override seasonal patterns, raising questions regarding the sustainability of year-end recovery hopes and whether current weakness represents healthy consolidation or the beginning of more substantial corrective forces.

Current Trading Levels and Market Capitalization

Bitcoin price today trading at $107,968.75 represents meaningful deterioration from recent price ranges, with Bitcoin November 2025 performance now tracking into negative territory for the month. The cryptocurrency’s market capitalisation currently stands at approximately $2.16 trillion, maintaining dominance by capturing over 50% of total global cryptocurrency market capitalisation despite recent percentage declines. This resilience in market share suggests Bitcoin’s fundamental position within digital asset hierarchies remains intact despite bitcoin price weakness today.

The $3,000 decline over three days reflects significant liquidation of leveraged long positions as traders reduce exposure amid mounting volatility and deteriorating technical conditions. On-chain analysis from leading cryptocurrency analytics platforms indicates that 24-hour trading volumes have surged 38%, signaling intense selling activity and forced liquidation of overleveraged traders who deployed excessive leverage during previous price strength.

Federal Reserve Policy and Macroeconomic Headwinds

The primary catalyst driving crypto price decline stems from Federal Reserve communications and evolving U.S. monetary policy expectations. The Fed Chair’s recent communications adopted a markedly hawkish tone, signalling reluctance toward aggressive interest rate reductions despite the September 50-basis-point rate cut. Market participants have substantially reduced expectations for December rate-cut probability, with current pricing suggesting merely a 25% likelihood of additional rate cuts before year-end, indicating that U.S. interest rates may persist at elevated levels throughout the foreseeable future.

U.S. Treasury yields maintained elevated levels across the yield curve around 4.2 to 4.5%, making risk-free fixed-income instruments increasingly attractive relative to volatile alternative assets lacking cash flow generation. This yield-driven environment creates structural headwinds for Bitcoin price today and other non-yielding cryptocurrencies that cannot compete on a risk-adjusted return basis against Treasury instruments offering similar or superior returns without associated volatility.

Additional macroeconomic uncertainty surrounding U.S. government funding and potential shutdown scenarios has collectively dampened risk sentiment across markets broadly, with cryptocurrency market segments experiencing particularly acute sensitivity to risk-off positioning. The convergence of elevated Treasury yields, hawkish Federal Reserve communications, and government funding uncertainty has created a hostile environment for risk-on asset classes, including cryptocurrencies.

Institutional Investor Selling and ETF Dynamics

Institutionalised digital asset trading activity has deteriorated significantly, with major institutional investors reducing cryptocurrency allocations amid macroeconomic uncertainty. Spot Bitcoin exchange-traded fund (ETF) outflows have accelerated alarmingly, with approximately $191 million exiting spot Bitcoin ETFs, according to UK-based financial analytics firm Farside Investors. These ETF outflows represent a troubling reversal from earlier 2025 patterns when Bitcoin ETF inflows had demonstrated consistent positive momentum.

ETF outflow acceleration suggests major institutional investors are systematically reassessing Bitcoin’s valuation and risk-reward dynamics given deteriorating macroeconomic conditions. This institutional capitulation represents a concerning trend reversal from earlier 2025 enthusiasm, when institutional participation had been cited as a critical support factor underlying Bitcoin’s price appreciation trajectory. Recent weakness indicates institutional investors are preferring capital preservation over cyclical exposure during periods of elevated macroeconomic uncertainty.

On-chain analysis from leading blockchain analytics platforms indicates a substantial reduction in institutional demand for Bitcoin despite lower absolute price levels. Typically, declining prices coupled with institutional participation would suggest value-buying opportunities attracting capital deployment. However, current institutional selling despite lower Bitcoin valuations suggests a fundamental reassessment of Bitcoin’s investment case rather than temporary profit-taking.

Liquidations and Technical Selling Pressure

Large-scale liquidations of leveraged Bitcoin November 2025 positions have intensified selling pressure as initial support level breaks triggered cascading forced liquidations. As margin traders’ positions underwater reach automated liquidation thresholds, algorithmic traders execute positions, creating self-reinforcing downward momentum. This cascade mechanism explains violent intraday price swings and accelerated declines frequently observed in cryptocurrency markets during periods of reduced liquidity and deteriorating technical conditions.

Liquidation monitoring platforms track position liquidations exceeding $500 million on individual exchanges, indicating substantial overleveraged positioning unwind. This forced selling adds mechanical downward pressure independent of fundamental developments, creating additional headwinds for Bitcoin price today recovery until leveraged positioning normalizes.

November Seasonality and Recovery Outlook

Historically, November has supported cryptocurrency market recovery following September-October weakness in traditional seasonal patterns. However, 2025’s current weakness challenges assumptions about seasonal support’s reliability during periods of acute macroeconomic uncertainty. Market analysts, including prominent trader Ali Martinez, have speculated whether the current market structure could still support a potential surge toward $250,000 by year-end despite current weakness, though the probability appears diminished.

Bitcoin requires critical support near $108,500 with resistance around the $110,500-$111,000 levels. Stabilisation at support levels could signal capitulation preceding recovery, while a breakthrough below support could trigger additional declines toward the $100,000-$105,000 range. Recovery scenarios depend critically on Federal Reserve policy clarity and U.S. economic data surprises potentially shifting expectations toward earlier rate reduction cycles.

Altcoin Performance and Broader Implications

Bitcoin weakness has cascaded throughout the cryptocurrency market, with Ethereum, Solana, Dogecoin, and Cardano experiencing significant declines. Nearly every major cryptocurrency is trading in negative territory, with altcoins down 25-40% from recent peaks. This systemic crypto price decline suggests a risk sentiment shift rather than Bitcoin-specific weakness, reducing the likelihood of alternative coins outperforming during the recovery phase.

Ethereum’s challenges have been particularly acute given the broader technology sector weakness mirroring Bitcoin’s decline. As institutional capital pullback affects all risk assets, digital asset trading activity suggests altcoins lack independent positive catalysts to drive relative outperformance versus Bitcoin during recovery phases.

Conclusion

Bitcoin price today weakness reflects genuine macroeconomic headwinds rather than cryptocurrency-specific negative developments. While crypto price decline appears acute currently, historical precedent demonstrates Bitcoin has endured significant drawdowns during macro uncertainty cycles, subsequently recovering to establish new highs. Current valuations may represent attractive entry points for long-term investors maintaining conviction in cryptocurrency adoption narratives, though near-term volatility appears likely to persist until macroeconomic clarity emerges from Federal Reserve communications and U.S. economic data.