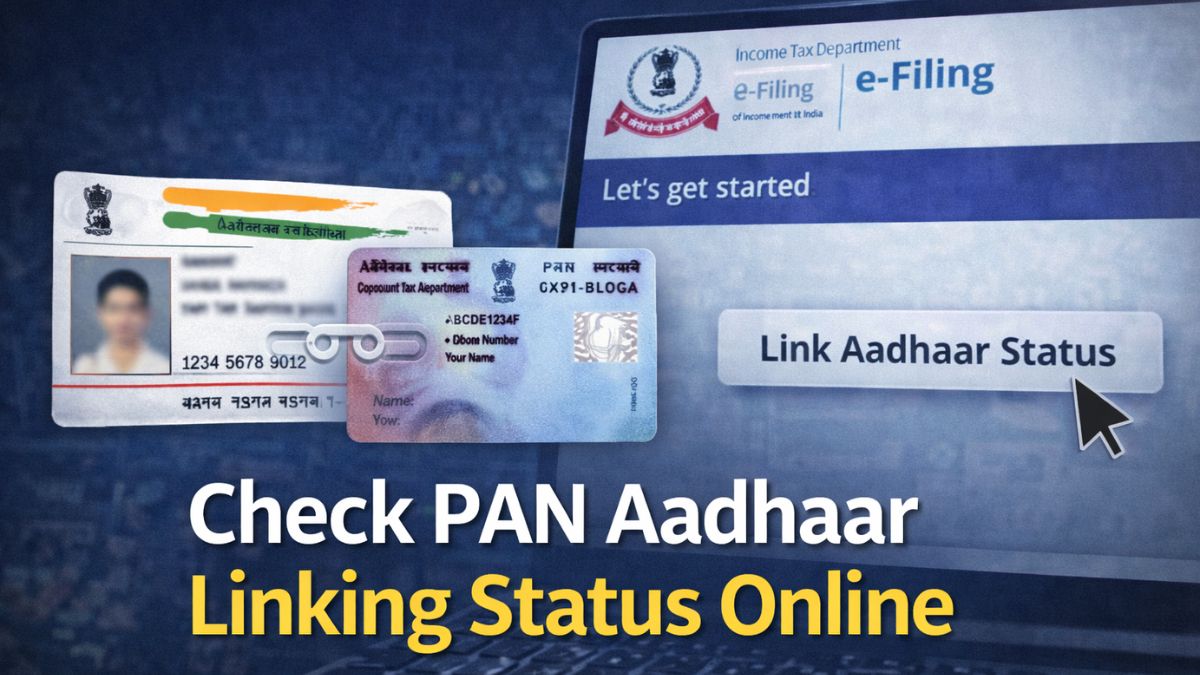

PAN Aadhaar linking status has become a critical check for millions of taxpayers across India, as the government continues to enforce compliance under income tax regulations. Individuals who have not linked their Permanent Account Number (PAN) with Aadhaar may face restrictions on financial transactions and tax-related services.

The Income Tax Department has provided a simple online facility that allows users to check PAN Aadhaar link status within minutes, without visiting any office.

Why PAN–Aadhaar Linking Is Important

Linking PAN with Aadhaar is mandatory under Indian tax laws to prevent duplicate PAN cards and improve transparency in financial transactions. Failure to complete the linkage can result in PAN becoming inoperative, affecting activities such as:

- Filing income tax returns

- Opening bank accounts

- Conducting high-value transactions

Officials have repeatedly urged taxpayers to verify their linkage status to avoid last-minute complications.

How to Check PAN Aadhaar Linking Status Online

Taxpayers can follow these steps to perform a PAN Aadhaar link status check:

- Visit the official Income Tax e-filing portal

- Click on the “Link Aadhaar Status” option

- Enter your PAN number and Aadhaar number

- Submit the details

The system will instantly display whether your PAN and Aadhaar are linked.

What the Status Results Mean

After completing the PAN Aadhaar linking online check, users may see:

- Linked: No further action required

- Not Linked: Linking needs to be completed

- Invalid Details: Aadhaar or PAN information mismatch

In case of mismatches, users may need to update their details either on the Aadhaar portal or with the Income Tax Department.

What to Do If PAN and Aadhaar Are Not Linked

If your PAN is not linked with Aadhaar, the Income Tax portal provides an option to complete the process online. Users may be required to pay a prescribed fee before submitting the request.

Once the request is submitted, confirmation is usually provided within a few days, depending on verification timelines.

Common Issues Faced by Taxpayers

Tax experts note that common problems during income tax PAN Aadhaar verification include:

- Name spelling differences

- Date of birth mismatches

- Incorrect Aadhaar number entry

Such issues can be resolved by updating details through the UIDAI or Income Tax portals.

Advisory for Taxpayers

Officials recommend checking PAN–Aadhaar linkage well in advance of tax filing deadlines. Relying on last-minute updates may lead to delays, especially during peak filing seasons.

Taxpayers are also advised to avoid third-party websites and rely only on official government platforms for verification and updates.

Where to Check Official Status

The Income Tax Department regularly updates guidelines and provides direct access to linking and verification services on its official portal. check here

Outlook

With increased digital enforcement and data integration, authorities are expected to further tighten compliance checks. Ensuring that PAN and Aadhaar are correctly linked will remain essential for uninterrupted access to tax and financial services.

Related: Step-by-Step Guide to Download Aadhaar Online 2025 Without Errors

Related: Digital Rupee Expansion: RBI Accelerates e₹ Rollout for 2026